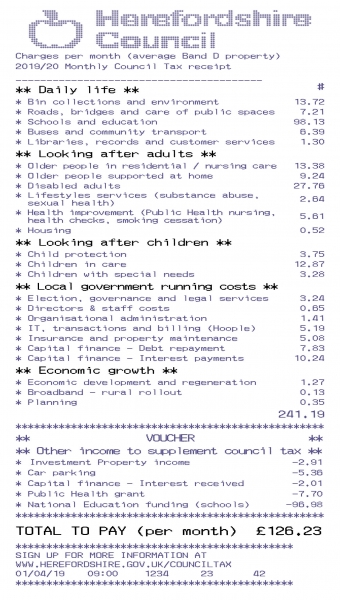

The budget till receipt shows how we propose to allocate funds from the council's portion of a Council Tax bill, for an average Band D property in 2019-20.

Herefordshire Council

Charges per month (average Band D property) 2019/20

________________________________________________________

| Daily life | |

|---|---|

| Bin collections and Environment | 13.72 |

| Roads, bridges and care of public spaces | 7.21 |

| Schools and education | 98.13 |

| Buses and community transport | 6.39 |

| Libraries, records and customer services | 1.30 |

| Looking after adults | |

| Older People in residential / nursing care | 13.38 |

| Older people supported at home | 9.24 |

| Disabled adults | 27.76 |

| Lifestyles services (substance abuse, sexual health) | 2.64 |

| Health improvement (Public Health nursing, health checks, smoking cessation) | 5.61 |

| Housing | 0.52 |

| Looking after children | |

| Child protection | 3.75 |

| Children in care | 12.87 |

| Children with special needs | 3.28 |

| Local government running costs | |

| Election, governance and legal services | 3.24 |

| Directors & Staff costs | 0.65 |

| Organisational administration | 1.41 |

| IT, Transactions and billing (Hoople) | 5.19 |

| Insurance and property maintenance | 5.08 |

| Capital finance - Debt repayment | 7.83 |

| Capital finance - Interest payments | 10.24 |

| Economic growth | |

| Economic development and regeneration | 1.27 |

| Broadband - rural rollout | 0.13 |

| Planning | 0.35 |

| 241.19 | |

| Other income to supplement council tax | |

| Investment Property income | -2.91 |

| Car parking | -5.36 |

| Capital finance - Interest received | -2.01 |

| Public Health grant | -7.70 |

| National Education funding | -96.98 |

| Total to pay (per month) | £126.23 |